Little Known Ways To Rid Yourself Of best silver ira

The Ultimate Strategy To best silver ira companies

June 12, 2023Für Leute, die mit Online Casinos Österreich anfangen möchten, aber Angst haben, loszulegen

June 13, 2023Little Known Ways To Rid Yourself Of best silver ira

Best Gold IRA: Top 12 Gold IRA Companies to Invest In

With a transfer, your current IRA custodian sends the money directly to your gold IRA custodian, and no cash is taken out of the account. How Can I Invest in Gold. I would recommend Noble Gold Investments for all your investment needs. Assets under custody as of 1/31/2023. When researching gold IRA reviews, it is important to understand the types of gold that can be held in a precious metals IRA. Their commitment to excellence, outstanding customer service, and extensive knowledge of the market make them reliable partners for investors who seek to safeguard their assets against market volatility and economic uncertainties. Precious metals IRAs have grown in popularity as a means of investing in precious metals. The IRS requires you to keep your IRA approved precious metals in a custodian account. Each of these companies has its own strengths and unique offerings, so it’s important to compare and contrast them to find the one that best suits your individual needs and preferences. Noble Gold Investments is an excellent choice for those looking to invest outlookindia.com in precious metals. What exactly is this account. GoldCo: The Most Trusted Name in Silver. Positive reviews indicate a reliable, reputable business that delivers a satisfactory experience, while negative reviews can alert you to potential issues like inconsistent work quality or unprofessional conduct.

7 Patriot Gold: Best For IRA

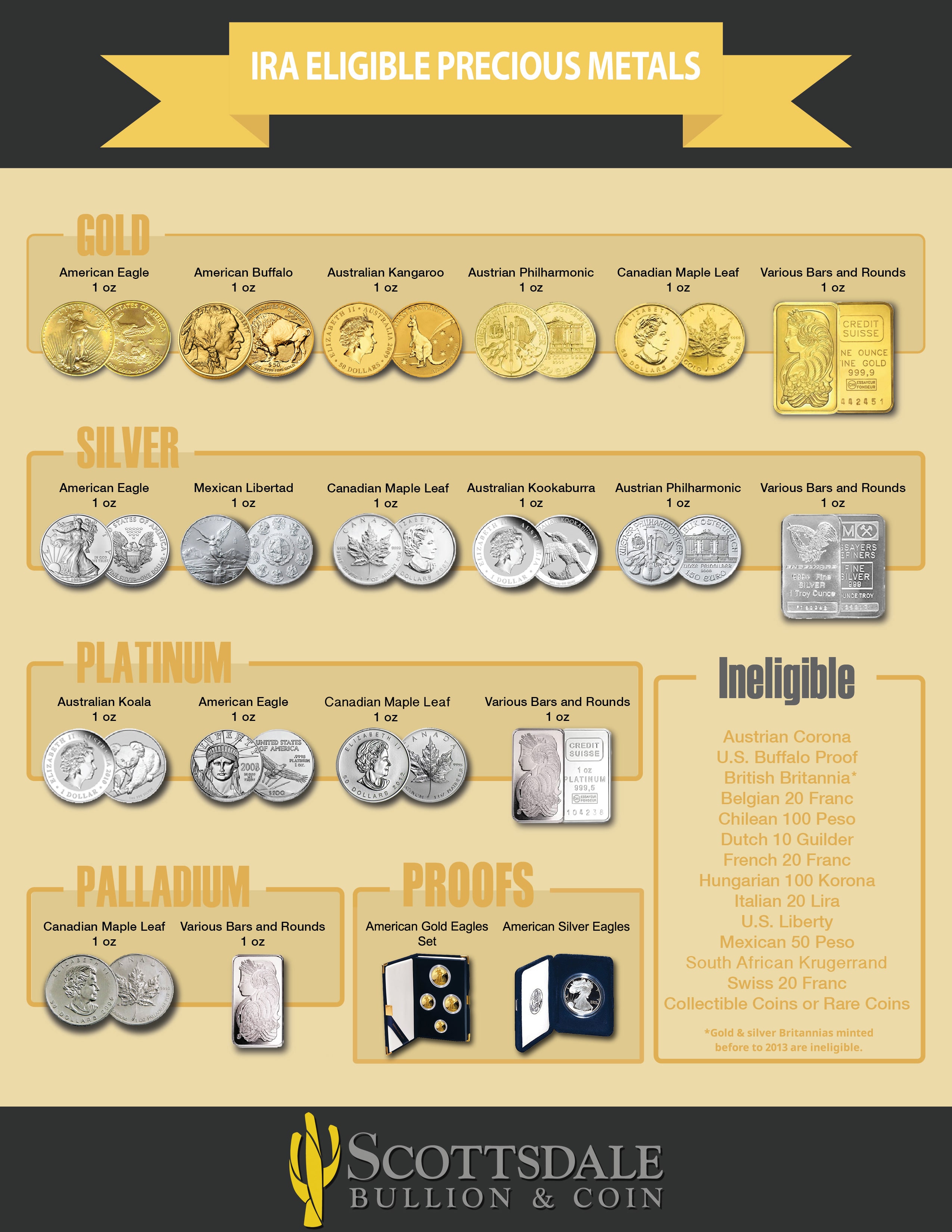

There is a simple way to buy physical bullion and avoid the taxes and penalties associated with liquidating an IRA prior to age 59 ½. You’ll also benefit from the convenience of being able to invest online without having to leave home or visit a physical location. You can hold IRS eligible gold, silver, platinum, or palladium in your precious metal IRA. If you’d like to talk to someone about setting up a precious metal IRA or transferring funds from an existing IRA, please call1 844 754 1349 with no obligation. When investing in gold and silver IRA accounts, it is important to choose products that meet the purity standards set by the IRS. How Much of My Portfolio Should I Hold in Gold. Gold IRAs have gained immense popularity among investors in recent years as a means to safeguard their retirement savings.

Subscribe and stay in touch

After submitting the form, a representative from Goldco will contact you to verify your address and provide a brief consultation. Many companies specialize in silver based IRAs and offer their services online. You’ll also pay a one time set up fee, which averages $100. We spent hours comparing and contrasting each platform’s investment products, fees, and features so you don’t have to. We have hopens PDF file ad a longstanding relationship with NDIRA and we hold our own precious metals IRA with them. Our goal is to listen and provide you with the information you need to make an informed decision. According to thousands of satisfied investors, the best gold IRA accounts in 2023 are. Yes, it is a good idea. For example, you can purchase mutual funds and exchange traded funds ETFs that invest in the securities of companies involved in the production of gold and/or other precious metals. Any silver coin or bar on our website that is eligible for Precious Metals IRAs will also be marked IRA Approved on the item page itself. A gold IRA has all the tax advantages of a traditional IRA while still giving you the protection of owning tangible assets.

1 Years in Business

Gold individual retirement accounts IRA are one method of investing in these precious metals. Some of the things to consider when choosing a silver IRA company include fees, storage options, and customer service. Learning how long a gold company has been in business is critical. Gold and other precious metals can act as a hedge against inflation, protecting you against market uncertainty and economic collapse. The best gold IRA companies offer a variety of services, from setting up a self directed IRA to providing advice on how to invest in gold. Experience Luxury with Oxford Gold Shop Now. In fact, customers should consider doing so if they want to have more than one option when it comes to their retirement funds. Some companies are easier to deal with than others, so if someone says they had a bad experience, you should not take this lightly because it might also impact your experience. Check with state regulators for any problems. Specialized safe deposit insurance services.

Silver IRA Company Reviews

It has earned a five star rating when it comes to customer satisfaction, and it makes complete sense it’s one of the most reputable silver IRA companies out there. These days, however, Gold IRAs are enjoying newfound popularity and are more viable than ever. Advantage Gold has a team of experienced professionals who are knowledgeable in gold investing and can provide customers with the best advice. Gold and silver are the two most lauded precious metal investments, due to their increased investor attention during rough economic times. From New Mexico free checking accounts and mortgages to small business banking and commercial lending services, WaFd Bank is here for all of your banking needs. As a custodian, NDTCO does not sponsor, endorse or sell any investment and is not affiliated with any investment sponsor, issuer, or dealer. Q: What types of gold are allowed in a gold backed IRA. Secure Your Financial Future with Advantage Gold. Krugerrands, and also Mexican 50 Pesos coins and old US gold coins are not legal investments for IRAs. By including gold in your IRA, you can reduce your overall risk and protect your nest egg from market volatility. A: Gold IRAs can be a worthwhile investment option for investors looking to hedge against inflation and economic uncertainty. Compared to other traditional IRAs which invest in stocks, real estate, and bonds, investing in a gold IRA is one of the safest investments you can make toward investment. These are the different types of precious metals IRAs that you can get.

5 Noble Gold: Best for Retirement Planning

Subscribe to get complete access to Outlook Print and Digital Magazines, Web Exclusive stories and the Archive. Additionally, gold IRA reviews can help customers compare services and fees to find the best gold IRA companies. 22105; Tennessee Mortgage License No. Providing diversification and liquidity with no credit risk, gold can be especially attractive during periods of increased market volatility. If you think your portfolio needs diversification and are considering other options, this guide is for you. American Bullion enables their members to acquire IRS permissible silver coins and bullions as part of their self directed IRA for long term inflation protection and more. It also offers a buy back commitment and no back end fees, helping you feel more confident in your investment.

2 Augusta Precious Metals

After all, the precious metals IRA company that you choose will be in charge of facilitating the security of your financial future. Instead of playing an endless game of phone tag or figuring out the fax machine, borrowers can do everything with a few simple taps on the device of their choosing. As the globe becomes more technologically dependent, so will our reliance on silver, boosting its demand and value. Overall, investing in a silver IRA can be a great way to diversify your retirement portfolio and take advantage of the potential for growth. This company works with Equity Trust, a reputable IRA custodian, and three trustworthy depositories. They also have a very simplified and easy to use dashboard. When customers join the company, they gain access to a library of content information, including blogs, eBooks, webinars, and free guides. It’s important to look for a reputable provider that offers secure storage and low transaction fees. Experienced and knowledgeable team of professionals. Experience the Magic of Gold Alliance Now. It can help hedge stock market volatility and preserve wealth. Their outstanding customer service ensures prompt and dependable responses to inquiries.

Cons

As the IRS returns to normal operations, collection activities will resume as well. The company’s experienced staff is knowledgeable in silver IRA investments and is always available to answer any questions customers may have. Here we provide a full analysis of this approach to using precious metals for your retirement plan. 995 fine the American Gold Eagle is the only exception while Silver must be at least. Setting up a Gold IRA is another way to invest in gold. Augusta offers a wide range of products for collectors and investors. Next to the rifles and some coins you inherited from grandma – hasn’t been found definitively to be a violation of IRS rules, but it sure looks like trouble, particularly because IRS rules do state that IRA assets cannot be commingled with other property. Their commitment to customer satisfaction and quality products make them a top choice for gold IRA investments. Their team provides a wide range of services for both individuals and businesses. Subscribe to get complete access to Outlook Print and Digital Magazines, Web Exclusive stories and the Archive. Discover the Benefits of GoldCo – Invest Now for Maximum Returns. You will select an IRS approved precious metals custodian that will manage your physical precious metals at a designated depository in Delaware, Canada or Grand Cayman. Learn how to invest your IRA/401K in silver. Many or all of the products featured on this page are from our sponsors who compensate us.

American Hartford Gold Group: Summary Gold and Silver IRA

This flexibility allows investors the ability to quickly sell gold if they need to raise funds. Invest in Your Financial Future with Birch Gold’s Secure Precious Metals Solutions. The tax is based on your profit from selling gold. Without it, you’d be essentially flying blind – leaving yourself open to potential losses and other risks. This type of IRA offers several advantages, including the potential for increased returns and a hedge against inflation. Going into a transaction of this magnitude unprepared or without the right knowledge could cost you money in the long run. If you feel that investing in gold is a worthwhile and manageable risk, then a gold IRA can provide a tax efficient means to invest. Customer service involves more than just handling customer complaints. GoldCo is committed to providing the best silver IRA services and products to its customers. Goldco is famous for providing clients with top notch customer service, but it has also earned positive reviews due to the number and variety of physical products it offers.

Apr 24, 2023

A: Investors can purchase gold and silver bullion for their IRA account through a qualified custodian or broker, who will ensure the proper storage and security of the precious metals. Noble Gold is famous because it goes above and beyond to help clients with their investments. 401ksIf you have an inactive 401k, meaning you no longer work with the company that created it, you can execute a gold IRA rollover. Additionally, it is important to look for reviews that are up to date and include information about any changes in fees or services. As an investment, gold has a number of advantages that make it an attractive option for those looking to add diversity to their retirement portfolio. If you take a distribution before age 59½, you will have to pay tax and early distribution penalties. Ready to start your Self Directed Gold IRA. Gold IRA accounts make an excellent choice if you want to lean into alternative investment. When we created our list of the best gold IRA companies, we reviewed the following factors in each option. MAJOR PAYMENT METHODS ACCEPTED. Known for one on one educational web conference designed by on staff, Harvard trained economic analyst. You can get your account created and funds transferred over in as short as 3 business days.

Filter by Metal:

Various secure storage options are offered for clients. They offer the usual lineup of paper assets – stocks, bonds, mutual funds, and money markets. Directed IRA is a Tradename of Directed Trust Company. Our industry leading tools allow for efficient response times so you’ll never be stuck waiting on us. While you can liquidate IRA metals for cash, doing so results in paying all applicable fees and taxes. Discover the Gold Standard of Quality with GoldCo. The custodian is responsible for choosing the depository, and these facilities must meet strict guidelines for security, insurance, and record keeping. Regal Assets is a precious metals investment company that provides a wide range of services to clients across the country. The company has a commitment to providing excellent customer service, offering a secure and reliable platform for clients to store their gold. Investing in precious metals can provide a hedge against inflation and market volatility, making it an attractive option for those looking to protect their retirement savings. Before doing that, however, consider checking your returns one more time to see if there’s anything that might save you money and make tax filing season easier next year. A pleasure doing business with them, I didn’t expect that. Gold backed IRAs are self directed accounts, meaning that investors can manage their own investments, and they can also be held in a traditional or Roth IRA. This has made them a convenient option clients can invest in because their value stands the test of time.

Benefits

As full members of the LBMA BullionVault is part of the world’s largest physical bullion marketplace. A precious metals IRA also known as gold IRA and silver IRA is a retirement account that allows you control over tangible assets. People also ask: How to Move a 401K to Gold Without Penalty. These reduce your monthly repayments but you may still owe a lump sum at the end of your loan. Unfortunately, a lot of investors aren’t aware of this option despite the fact that people have been using it to hold assets such as real estate, privately held company shares, and bullion for decades. Choose your precious metals dealer, decide which items you want your account to buy, complete the necessary paperwork, and execute the purchase. Learn how to optimize your MLS website through SEO in month. They have many different bullions, including bars and coins.

North and South America

Precious metals and rare coins are speculative purchases and involve substantial risks. Whether you are getting started with investing or even a seasoned collector, Golden Eagle Coins has a selection of gold and silver bullion that you will find helpful. Whether you are a new investor or an experienced one, taking the time to research and select a reputable company can make all the difference in your investment success. Remember that most precious metals IRA companies have minimum investment costs for their IRA assets. RC Bullion also provides comprehensive guidance to help customers make informed decisions about their gold investments. Best Gold IRA Companies. People who want to stabilize and diversify their portfolios should consider precious metal IRAs. Traditional IRA users must start taking an annual distribution from their accounts no later than April 1 in the year after turning 72 years, irrespective of their employment status. So, by using these two resources, you can gain insight into how each company manages consumer issues. These metals can be in bar or coin form as long as the assets meet purity standards and other requirements set by the IRS.

BUYING PRECIOUS METALS IN YOUR IRA

Although the value of these metals may vary, it has an intrinsic value that is immutable and permanent. Hedge Against Inflation. The same IRA withdrawal rules apply to gold IRAs. There will always be a demand for gold. They ensure every one of their customers are well versed on gold and silver and the happenings of the financial market as a whole. 999 pure silver coin with a face value of 1. Lastly, companies offering services for free may be shady because their process is not fully transparent. Of course, the IRS would prefer that not happen. When considering a gold IRA rollover, it is important to select one of the best gold IRA companies to ensure the process is completed correctly and efficiently. The company claims they can identify the specific type of precious metal items you need and deliver them quickly and securely. Age Related Considerations for IRA Owners. However, it’s still worth checking exactly what fees may apply as some companies do charge extra depending on the type of transaction or asset being purchased. It’s impossible to predict when or if this will happen again.

Legal

Ultimately, the best type of IRA for you will depend on your financial goals and situation. Oxford Gold Group: Best customer service. Discover the Beauty and Value of Augusta Precious Metals Today. Additionally, American Hartford Gold offers financial planning services, making it easy for investors to develop a comprehensive investment strategy that meets their long term goals. The No Fees for Life IRA can help you save a lot on fees compared to other gold IRAs. You can learn more about gold and silver investments on the company’s online Knowledge Center. Keep in mind that there are specific rules set out by the IRS regarding how gold can be bought and stored. Checked for accuracy by our qualified fact checkers and verifiers. American Hartford Gold makes it on this list for two key reasons offering a wide range of precious metals investment options such as platinum, gold, and silver – in both coin and bullion form, at reasonable prices, and, their exceptional customer services. They will have a range of IRS approved coins for you to choose from. There are many silver IRA companies to choose from, so it is important to do your research and find the best silver IRA company for you.